SEC Form 5 Filling Made Simple

Prepare and submit your Form 5 filings with our Section 16 software with a quick 5 step process.

What is Form 5?

Form 5 is the annual statement of beneficial ownership filed with the SEC. Corporate insiders—directors, officers, and anyone holding more than 10% of a registered class of securities—must file it to report certain insider transactions that were not required to be disclosed earlier on Form 4.

- Deadline: Must be filed within 45 days after the end of the companys fiscal year.

- Why it matters: Ensures that any transactions that slipped outside the two-day Form 4 requirement or were eligible for deferred reporting are fully disclosed.

- Common triggers: Small acquisitions exempt from Form 4, transactions under Rule 16b-3, or ownership changes not reported during the fiscal year.

Why Form 5 Filing is Important

Form 5 is the final checkpoint for insider ownership reporting each year. It provides a comprehensive view of all insider transactions, ensuring no gaps in disclosure.

Annual Obligation

Even if no reportable transactions occur, insiders may need to file Form 5 to confirm compliance.

Investor Confidence

Consolidating and disclosing all missed or deferred insider transactions reassures investors that nothing is hidden.

Regulatory Oversight

Late or missed Form 5 filings can lead to SEC penalties and reputational damage.

Closing the loop

Since it covers items not reported on Form 4, Form 5 ensures completeness and transparency in annual reporting.

How Form345 Simplifies Your Form 4 Filing

Form345.com streamlines the year-end filing process by making it simple to compile, validate, and submit annual disclosures. Our key features include:

Auto-populate Form 5 transaction data data into your filing including filer information and relationships.

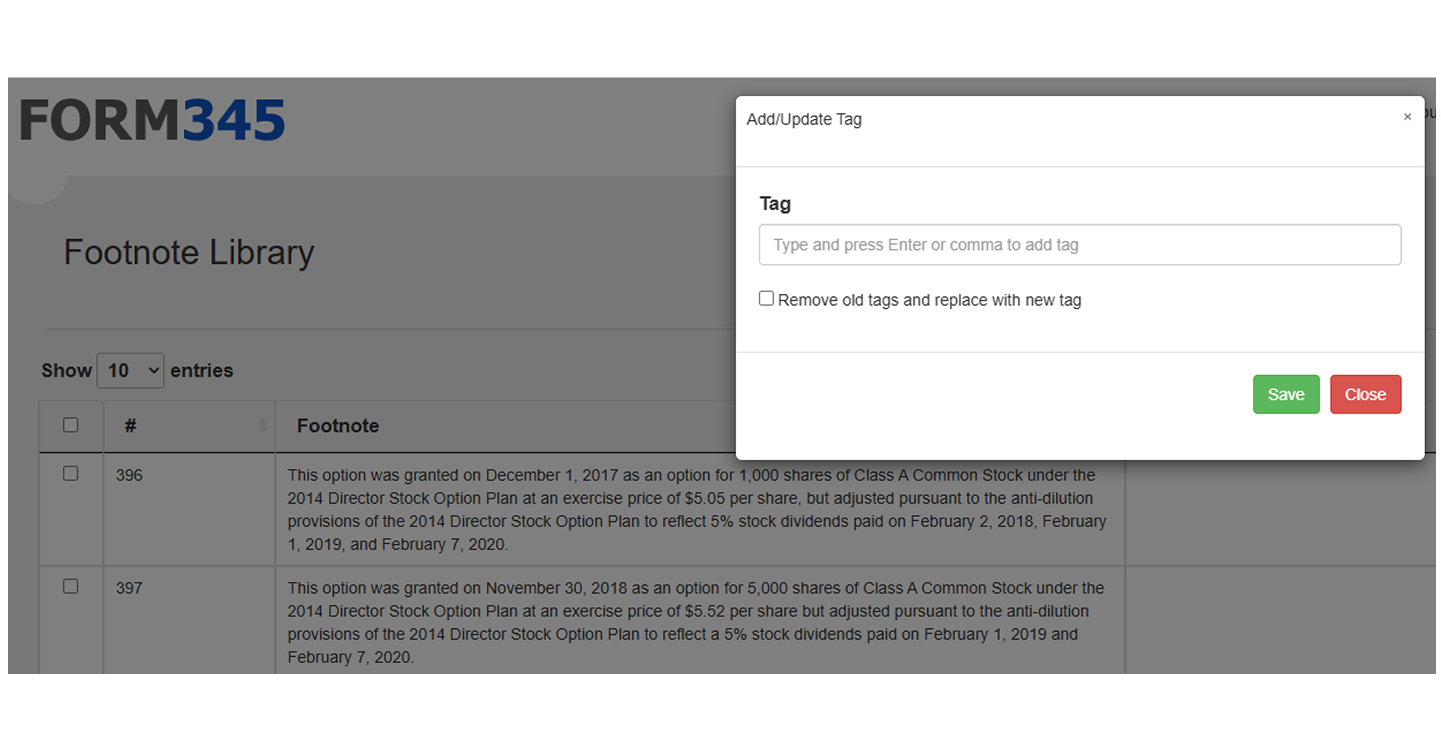

Smart tagging for footnotes, entities, and holding rows added to the form.

Deadline tracking so you never miss the 45-day post-fiscal-year cutoff.

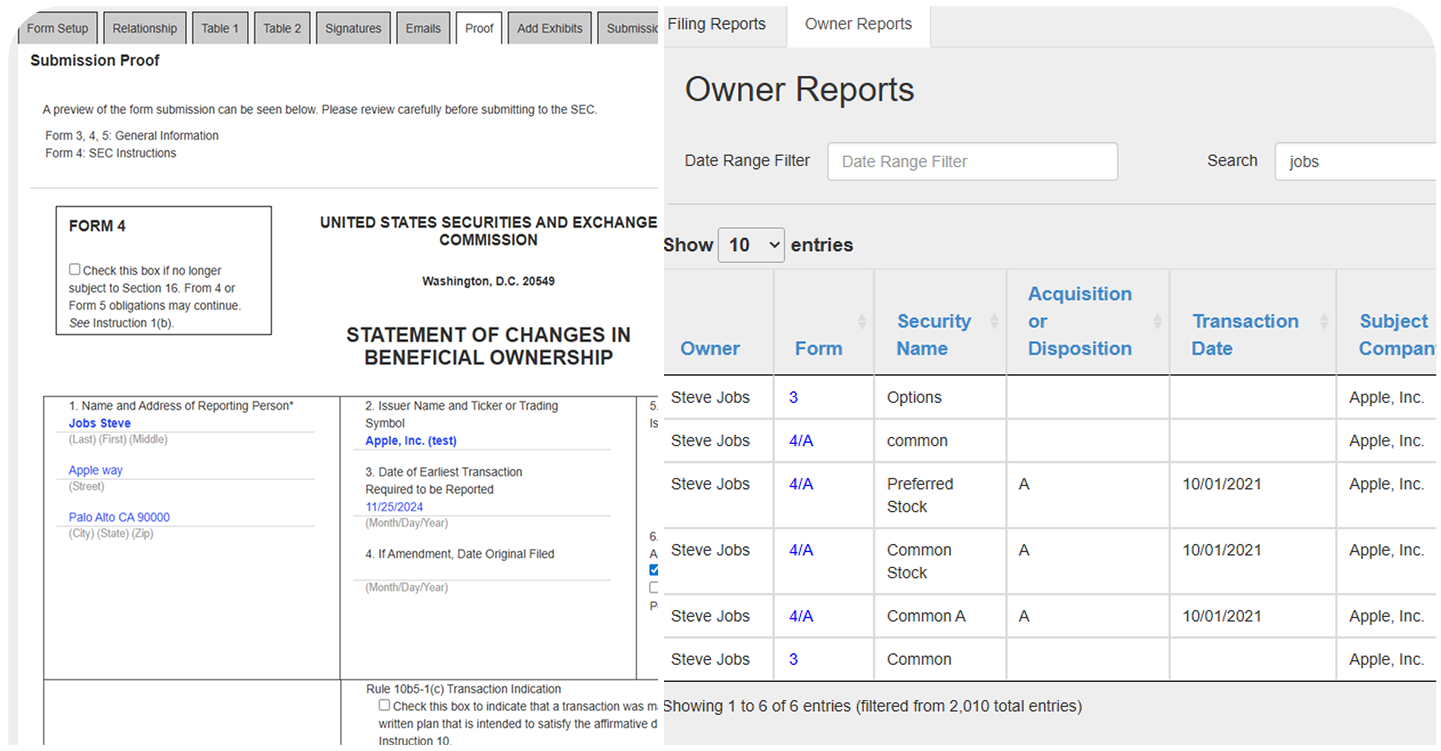

Printable proofs & audit trails for legal and compliance reviews.

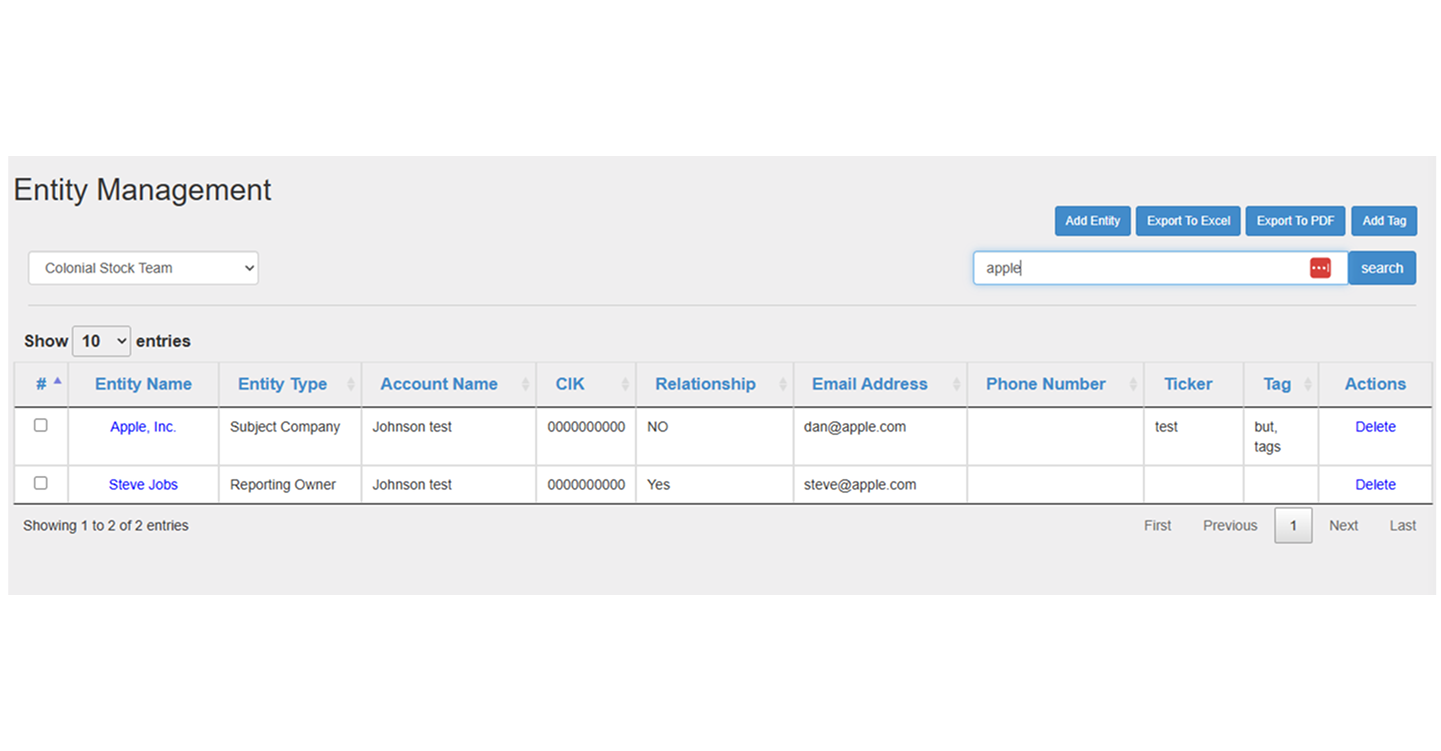

Centralized insider management to handle multiple insiders across a company.

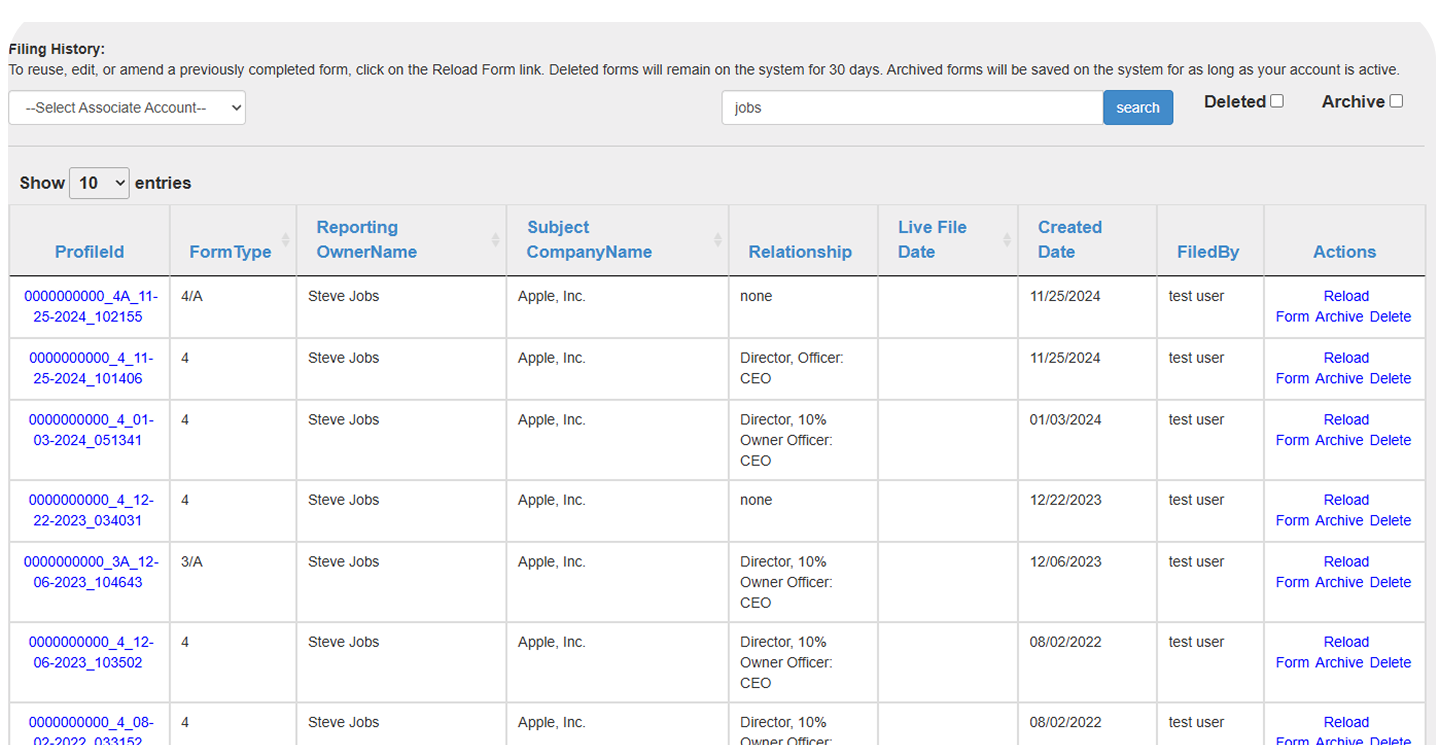

Submission history access for reviewing filings across the year.

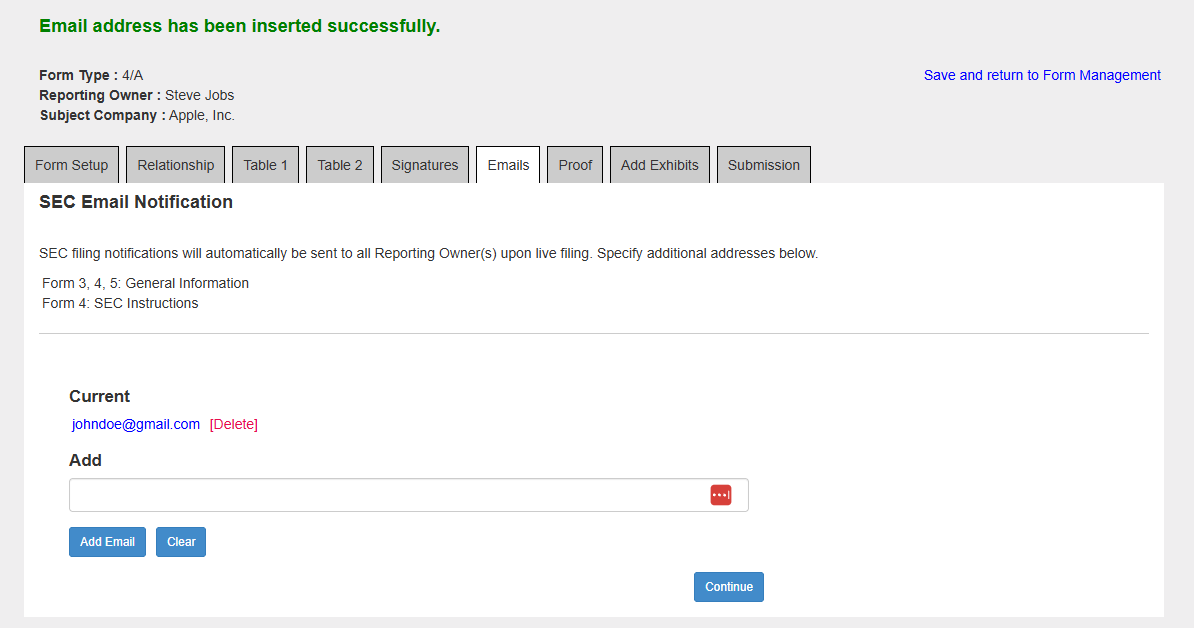

Instant email confirmations to verifying SEC acceptance.

How Form345 Simplifies Your Form 5 Filing

Form345.com is built to simplify insider filings. Whether you’re filing Form 3, Form 4 or Form 5, the process is simple:

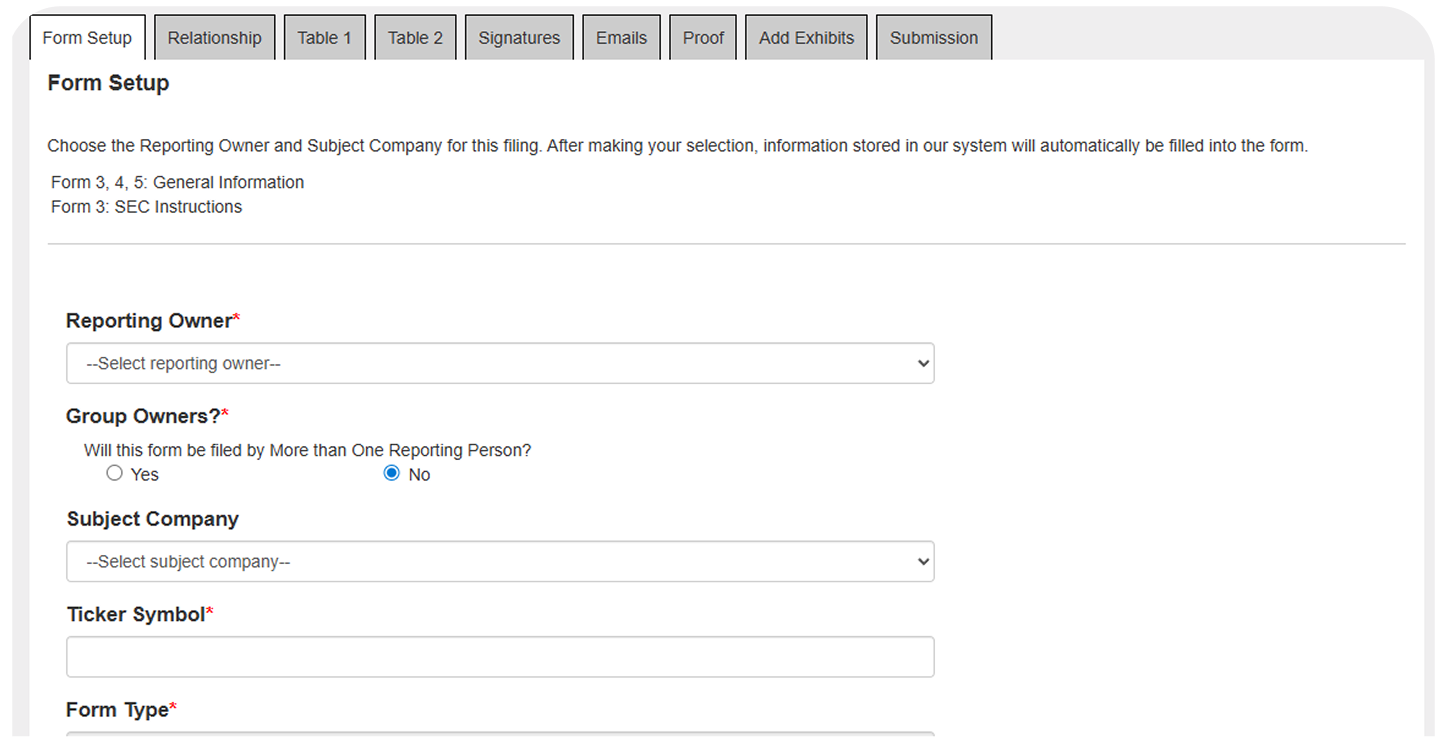

Step 1: Enter Information

Quickly input insider details and ownership data into our guided form. No need to worry about missing fields—our platform prompts you for everything required.

Step 2: Create Filers

Set up insider profiles once and reuse them across multiple filings. This saves time when filing for multiple executives or beneficial owners.

Step 3: Create Form

Generate your Form 5 through our Section 16 filing platform. Our system automates much of the process with proper XML filing formats according to the latest SEC rules.

Step 4: Validate

Before submission, the platform runs built-in compliance checks to catch errors, omissions, or formatting issues. This reduces the risk of SEC rejections.

Step 5: Submit

File directly to the SEC’s EDGAR system with one click. You’ll receive confirmation emails and can download proof copies for your records.

This 5-step workflow is intuitive, automated, and eliminates the need to be an EDGAR expert.

Get Started with Form 5 Filing Today

Don’t let compliance delays or formatting errors get in the way of your responsibilities. With Form345.com, you can ensure that your Form 3 filing is submitted accurately, on time, and in full compliance.

Contact us for a demo and start your Form 3 filing today with confidence.